U.S. Reciprocal Tariff 2025: Strategic Responses for Global Businesses

In this environment, offshore corporate structures (offshore companies) may offer valuable pathways for businesses to protect profit margins, diversify market exposure, and safeguard assets amid escalating uncertainty.

Understanding the Fair and Reciprocal Plan

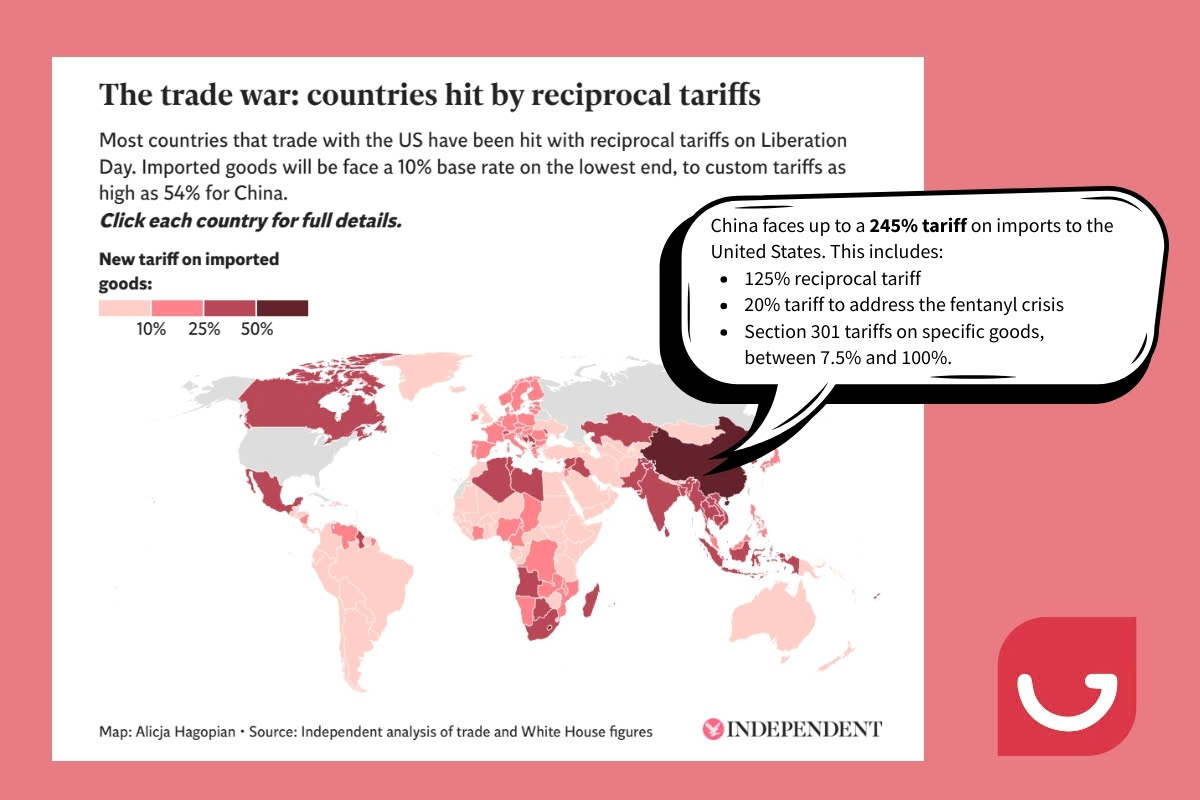

The new U.S. trade framework imposes:

-

- A baseline 10% tariff on imports from numerous trading partners, including the UK, Brazil, Singapore, Australia, Chile, Argentina, and Saudi Arabia.

- Higher tariffs (20%–26%) targeting goods from the EU, Malaysia, Japan, Korea, and India.

- Extreme tariffs, notably 125-245% on China and 46% on Vietnam, signal a sharp escalation in trade tensions.

- A baseline 10% tariff on imports from numerous trading partners, including the UK, Brazil, Singapore, Australia, Chile, Argentina, and Saudi Arabia.

Although the U.S. has temporarily deferred certain tariffs for 90 days to facilitate negotiations, the business community remains on high alert. Concerns over a potential global trade war — possibly surpassing the 2008 financial crisis in severity — are intensifying.

Industries Most Affected

The sectors most vulnerable to tariff shocks include:

-

- Manufacturing

- Import/Export

- E-commerce and Dropshipping

- Logistics and Supply Chain Services

- Manufacturing

These industries now face critical challenges:

| Risk Area | Impact |

| Rising Cost of Goods | Increased import costs erode margins for businesses reliant on U.S. inputs or suppliers. |

| Reduced Competitiveness | Tariff-induced price hikes weaken the market position of foreign companies relative to U.S. domestic producers. |

| Lower Trade Volumes | Higher prices and stricter customs rules threaten to dampen consumer demand and business revenues. |

| Administrative Complexity | Navigating new customs procedures and compliance rules increases operational burdens. |

| Supply Chain Disruptions | Companies face costly sourcing shifts and logistical realignments. |

| Retaliatory Tariffs | Countermeasures from affected countries could further constrict international market access. |

Strategic Adaptations: How Global Businesses Should Respond

To preserve competitiveness and financial resilience, businesses must adapt swiftly. Key strategies include:

1. Market Diversification and Supply Chain Re-engineering

Businesses should actively pursue new markets outside the U.S. and reconfigure supply chains to minimize dependency on vulnerable regions.

For example, setting up offshore companies in Hong Kong can offer tax advantages and closer access to burgeoning markets like China, leveraging Hong Kong’s robust trade agreements and territorial tax system.

2. Corporate Structuring in Offshore Jurisdictions

Relocating or structuring operations through offshore jurisdictions such as the Cayman Islands, Marshall Islands, or Singapore can help mitigate the impact of U.S. tariffs. These jurisdictions offer:

-

- Favorable corporate tax regimes

- Reduced regulatory exposure

- Flexible business frameworks are ideal for cross-border trade

- Favorable corporate tax regimes

For U.S. engagement, using a U.S.-domiciled LLC (US LLC) could allow foreign businesses to operate more flexibly while reducing exposure to heightened tariffs.

3. Asset Protection Strategies

Implementing offshore holding companies, trust structures, and international banking solutions (e.g., in the British Virgin Islands, Seychelles, or St. Kitts & Nevis) can help businesses:

-

- Shield corporate and personal assets

- Optimize tax exposure

- Safeguard wealth against potential creditor claims and legal disputes

- Shield corporate and personal assets

Conclusion: Agility Will Define Survival

The Fair and Reciprocal Plan introduces substantial risks but also compels international businesses to become more globally agile. Companies that re-engineer supply chains, strategically deploy offshore structures, and strengthen asset protection will be better positioned to navigate volatility and capitalize on emerging opportunities.

While offshore strategies offer powerful tools for resilience, they are not one-size-fits-all. Success will depend on careful planning, legal compliance, and professional advisory support.

In today’s new trade era, agility and global foresight are not optional — they are the defining traits of the next generation of market leaders.

%20(1).jpg)