New US Tariffs on China: Impact on Offshore Companies Incorporated in Hong Kong

Territorial Tax Advantages Remain Intact

Offshore companies registered in Hong Kong operate under a territorial taxation regime. This means that profits derived from outside Hong Kong are not subject to local tax, providing a significant advantage for internationally focused businesses. Profits sourced within Hong Kong are taxed at the following rates:

-

- 8.25% on the first HK$2 million

- 16.5% on profits exceeding HK$2 million

These rates remain unchanged by the recent U.S. tariff policies.

Tariff Exposure Is Based on Goods’ Origin, Not Company Jurisdiction

While the tariff framework implemented by the U.S. does impact companies directly involved in U.S.-China trade, this does not extend to the broader universe of offshore firms.

Hong Kong offshore companies typically:

-

- Have no physical presence in Hong Kong

- Conduct business across multiple jurisdictions

- Do not trade directly with the U.S. or China in many cases

Therefore, unless an offshore company is engaged in direct cross-border logistics involving U.S. or Chinese goods, it is unlikely to be affected by tariff measures.

However, the important point is not the place of incorporation. This means: tariffs are assessed based on the origin of goods.

-

- Goods manufactured in mainland China or Hong Kong and shipped to the U.S. may attract tariffs

- Goods shipped from third countries typically follow the tariff rates of goods’ country of origin, regardless of the company registration location

Let’s dive into the details of How Tariffs are imposed: Origin vs. Departure Location

In international trade, tariffs are typically imposed based on the country of origin of the goods, not the port of departure or the country of the exporting company. Here's a detailed explanation:

Tariffs are applied according to the origin of goods, which is determined by where the product was substantially manufactured, produced, or processed.

Example:

-

- A product manufactured in mainland China, but shipped from Hong Kong to the U.S., is still considered of Chinese origin.

- Therefore, U.S. tariffs on Chinese goods apply, even if Hong Kong is the departure port.

Determination Factors:

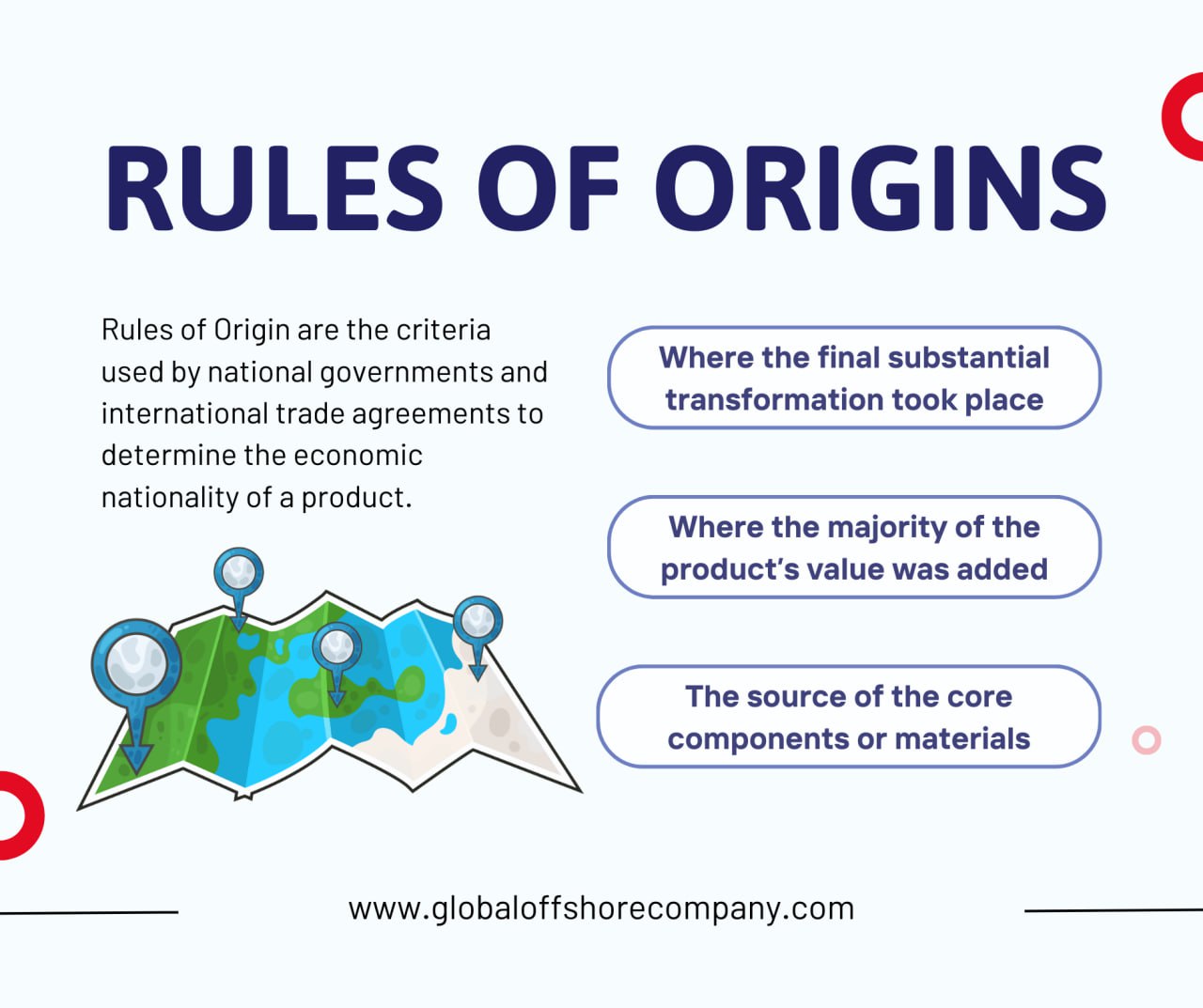

Customs agencies apply “rules of origin” to classify a product’s origin. This can include:

-

- Where the final substantial transformation took place

- Where the majority of the product’s value was added

- The source of the core components or materials

The location where the product is exported from (the port)—whether it’s Hong Kong, Singapore, or Dubai—is largely irrelevant to whether tariffs apply.

Instead, customs authorities in the importing country (e.g., U.S. Customs and Border Protection) assess the origin to decide:

-

- What tariff rates to apply

- Whether import restrictions, quotas, or duties are relevant

The commercial invoice, bill of lading, and certificate of origin must correctly declare:

-

- The country of origin of the goods

- The Harmonized System (HS) code

- Supporting documents for free trade agreements (FTAs), if applicable

Falsifying this information can lead to:

-

- Penalties or fines

- Seizure of goods

- Loss of trade privileges

Key Takeaway for Business Owners

|

Scenario |

Tariff Applies? |

|

Goods made in China, shipped from China to the U.S. |

Yes |

|

Goods made in China, shipped from Hong Kong to the U.S. |

Yes |

|

Goods made in Vietnam, shipped from Hong Kong to the U.S. |

No (unless reworked in China) |

So, unless the manufacturing or substantial processing happens in a third country, tariffs based on the original manufacturing location will apply — even if your company is incorporated elsewhere or ships from a low-tariff port.

Conclusion: Minimal Impact for Most Offshore Entities

At present, U.S. tariffs on Chinese exports do not impose direct consequences on Hong Kong offshore companies, unless those entities are actively trading goods between Hong Kong/China, and the United States. The core tax benefits and structural advantages of setting up in Hong Kong remain unchanged.

Businesses with indirect exposure to U.S.-China trade should monitor ongoing developments carefully, particularly as geopolitical conditions continue to evolve. For all other offshore firms, the current landscape remains favorable.

Looking Ahead

G.O.C. will continue to monitor updates on U.S. trade policy and assess any changes that could affect offshore business operations in Hong Kong.

For business owners considering offshore company formation or looking to evaluate their risk exposure, we encourage you to contact G.O.C. for a personalized consultation tailored to your global business strategy.

%20(1).jpg)