Demystifying Singapore's Notice of Assessment (NOA): Gaining Clarity on Taxation Details and Their Relevance

Introduction

For businesses and individuals navigating Singapore's taxation system, the Notice of Assessment (NOA) stands as a pivotal document that holds significant importance. But what exactly is the NOA, and how does it impact your tax compliance journey? In this comprehensive article, we delve into the intricacies of the NOA, shedding light on its role in ensuring transparency, accuracy, and effective tax planning.

1. Understanding the NOA in Singapore

The Notice of Assessment, commonly referred to as the tax bill computed based on the tax form(s) that you have submitted and/or information sent, issued by the esteemed Inland Revenue Authority of Singapore (IRAS). Much more than a mere document, the NOA offers taxpayers – both individuals and businesses – a comprehensive overview of their tax assessment for a specific fiscal year.

This crucial piece of documentation provides insights into various taxation details, including your total income amount, deductions, tax liabilities, and the amount you owe to the authorities. It's a snapshot of your financial year's tax-related transactions and obligations, helping you ensure compliance and navigate the complexities of Singapore's taxation system.

2. Distinguish types of notice of assessment (income tax bill)

- NOA (Amendment): If IRAS amend your tax assessment, you will receive a Notice of Amended Assessment accordingly. The 'Previous assessment' will show your tax payable from your aforehand tax bill. IRAS will provide you with a refund of the credit amount, if there is any credit in your tax account.

- NOA (Additional): In case IRAS revise your tax assessment, you will need to pay the additional taxes which is shown as 'Additional Tax Payable'.

- NOA (Repayment): Applied if there is any credit amount to be refunded to you

- NOA (Estimated): IRAS may estimate your tax based on information available and send you the Estimated Notice of Assessment, if you have not filed your Income Tax Return by the due date.

3. Unveiling the Taxation Insights of NOA

Interpreting the Notice of Assessment goes beyond merely understanding the numbers. It's about comprehending the implications of the information provided and how it affects your financial commitments. Here's a breakdown of key points to help you decode the significance of the NOA:

Assessable Income Amount: This figure represents your total income amount, as reported in your Estimated Chargeable Income filing or the relevant tax return forms, after deducting allowable expenses and approved donations. Normally, the total income includes: employment income; trade income for the accounting year; and/or other income such as rental income.

Chargeable Income Amount: The IRAS levies taxes on your actual taxable income, calculated by deducting relevant allowable deductions from the Assessable Income Amount. It's the core basis upon which your tax obligations are determined.

Tax Payable: This represents the exact amount of tax you must pay, determined by the current tax rates applied to your chargeable income. It signifies your company's tax liability and underscores the financial responsibility to settle the owed amount within the stipulated timeframe.

Tax Repayable/Discharged Amount: In scenarios where the IRAS finds that the final tax payable amount is less than what you initially paid according to the initial NOA, the excess amount will be refunded to your company. This adjustment is reflected in the final tax bill.

Understanding Four Types of NOA

Type 1 NOA

The Type 1 NOA is the tax bill provided by the IRAS a few months after a timely Estimated Chargeable Income (ECI) submission. This submission should occur no later than three months after the financial year concludes. It signifies that your company's ECI filing has been completed, ensuring tax compliance. However, no Type 1 NOA is issued for nil ECIs.

Type 2 NOA

This NOA is triggered under the following circumstances:

- Failure to submit ECI within three months after the fiscal year (unless waived)

- Missing the IRAS deadline for Form C/Form C-S/Form C-S (Lite) submission

- Significant disparity between declared ECI and Form C/Form C-S/Form C-S (Lite)

- Advance tax assessment cases

Upon receiving the Type 2 NOA, you have the option to file an objection against its contents.

Type 3 NOA

After filing Form C/Form C-S/Form C-S (Lite), the IRAS compares the ECI in Type 1 NOA with the tax form's new information. If differences arise, the Type 3 NOA is issued, highlighting any variations and adjustments. IRAS automatically updates the ECI for the next NOA, eliminating the need for an objection.

Type 4 NOA

The Type 4 NOA marks the final assessment with any adjustments made by the IRAS. This document is issued around 31 May of the following year for companies with straightforward affairs. Upon review, necessary actions such as tax payment or filing objection notices should be taken within two months from the issuance date.

Obtaining and Managing Your NOA: A Step-by-Step Guide

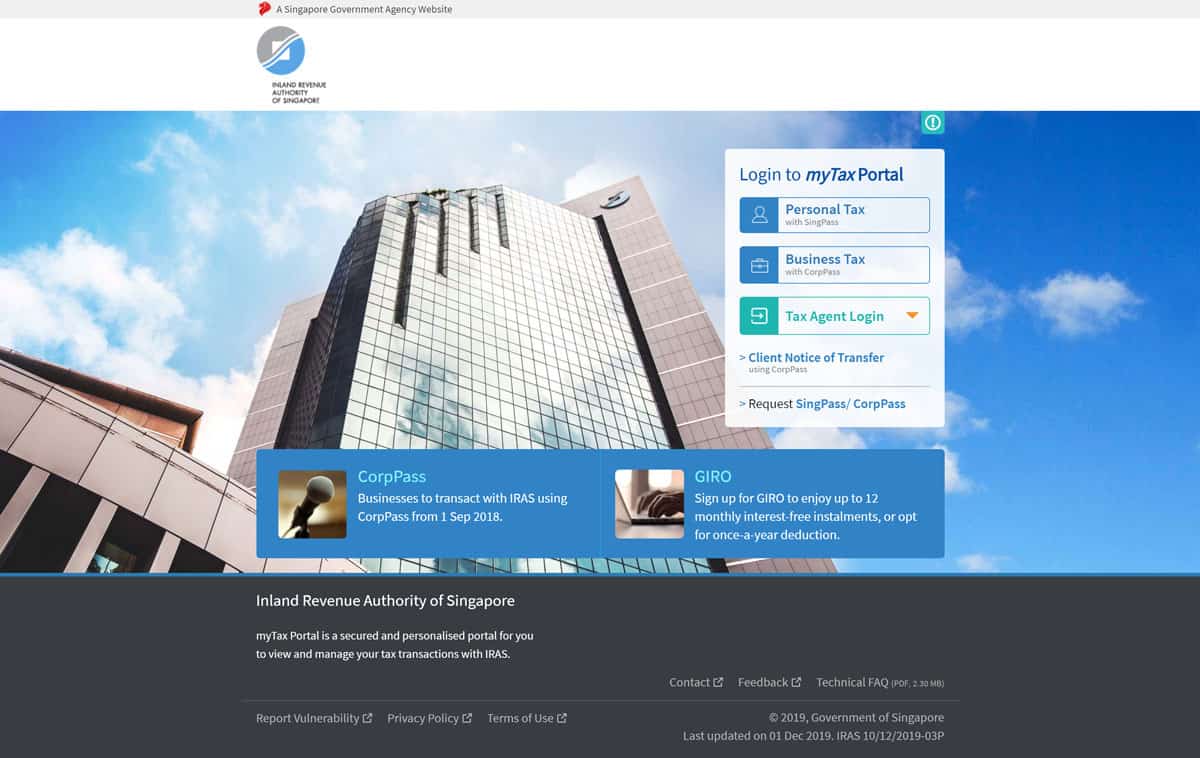

The myTax Portal, managed by the IRAS, serves as a convenient platform to access and manage your tax bills. Here's how you can retrieve your tax bills for the current Year of Assessment and the three preceding years:

1. Log in: Use your Singpass to access the myTax Portal. ( Your local Singapore corporate secretacry will perform the task on your behalf if you are a foreigned owners of your Singapore company)

2. Navigate: Click on the "Notices/ Letters" section.

3. Select Category: Choose "Corporate Tax."

4. View Notices: Click on "View Notices" to view and download the copy

This option is not only free but also time-efficient, allowing you to conveniently manage your tax documents online.

Requesting Tax Bills Not Available on myTax Portal

When your NOAs are not accessible via the online portal, you have the option to request a copy of the tax bill directly from the IRAS Revenue House. Follow these steps:

1. Visit IRAS: Personally visit the IRAS Revenue House to request the copy (up to 7 years back, subject to availability).

2. Fees Apply: You need to pay the search fee of SGD 20 and a fee per page of the document (SGD 3 per page for certified copies or SGD 0.3 per page for uncertified copies).

3. Paymen: Conduct payment through Internet Banking Fund Transfer to the designated IRAS bank account.

If you're unable to visit in person or a foreigners of your Singapore company, a Singapore representative or tax agent can obtain the NOA on your behalf. However, specific requirements must be met:

1. Authorization Letter: Prepare a comprehensive authorization letter containing your full name, signature, NRIC number/FIN and a description of the required documents (the NOA).

2. Representative's Details: Include your representative's full name and NRIC number.

3. Identification: Your representative should carry their original NRIC during the process (if not available, please provide a scanned copy of your passport).

Conclusion

Navigating the intricacies of obtaining and managing your Notice of Assessment is crucial for effective tax compliance and financial planning. Whether through the myTax Portal or alternative methods, maintaining proper documentation and proactive management are key to ensuring the smooth operation of your Singapore business. By understanding the process and available options, you can confidently manage your tax-related documents and obligations.

For seamless guidance through Singapore's tax landscape, consider seeking assistance from the experienced professionals at Global Offshore Company, offering tailored solutions for your specific business needs.

Disclaimer: While Global Offshore Company (G.O.C) endeavors to provide timely and accurate information on this website, the content is intended for reference purposes only. The information presented in this article should not be considered a replacement for qualified legal advice. For personalized guidance on your specific circumstances, we encourage you to reach out to G.O.C's experienced consultants.